Last week, the Organisation for Economic Co-operation and Development (OECD) released a trove of new documents on a draft multilateral taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

treaty. The document dump is connected to OECD Pillar 1The Organisation for Economic Co-operation and Development (OECD) has been targeting proposals to reduce incentives for tax planning and avoidance by U.S. and foreign multinational companies by limiting tax competition and changing where companies pay taxes. Pillar 1 of the OECD’s current proposal would expand a country’s authority to tax profits from companies that make sales into their country but don’t have a physical location there. This was decided as part of the OECD/G20 Inclusive Framework.

, Amount A which is a proposal to change where large multinational companies pay taxes on their profits.

Currently, companies generally pay taxes on their profits in locations where their production occurs. If you have a factory and workers in a country, you pay taxes on profits associated with those activities. Also, if you have intellectual property with high profit margins in another country, and sales and distribution activities (with low profit margins) in yet another country, your taxable profits are supposed to align with the profits generated.

In contrast to this production-based allocation, Pillar One, Amount A would allocate a share of profits from where the largest multinationals are currently being taxed to jurisdictions where their final customers are located. This is done through a set of rules that require companies to do their best to determine where the end users of their products are located. Even if a company is selling an intermediary good to another business, they are expected to determine (to the best of their ability) where their products are purchased by consumers.

Below are five important takeaways from the new documents.

1. The draft treaty presents a path to removing (at least some) digital services taxes.

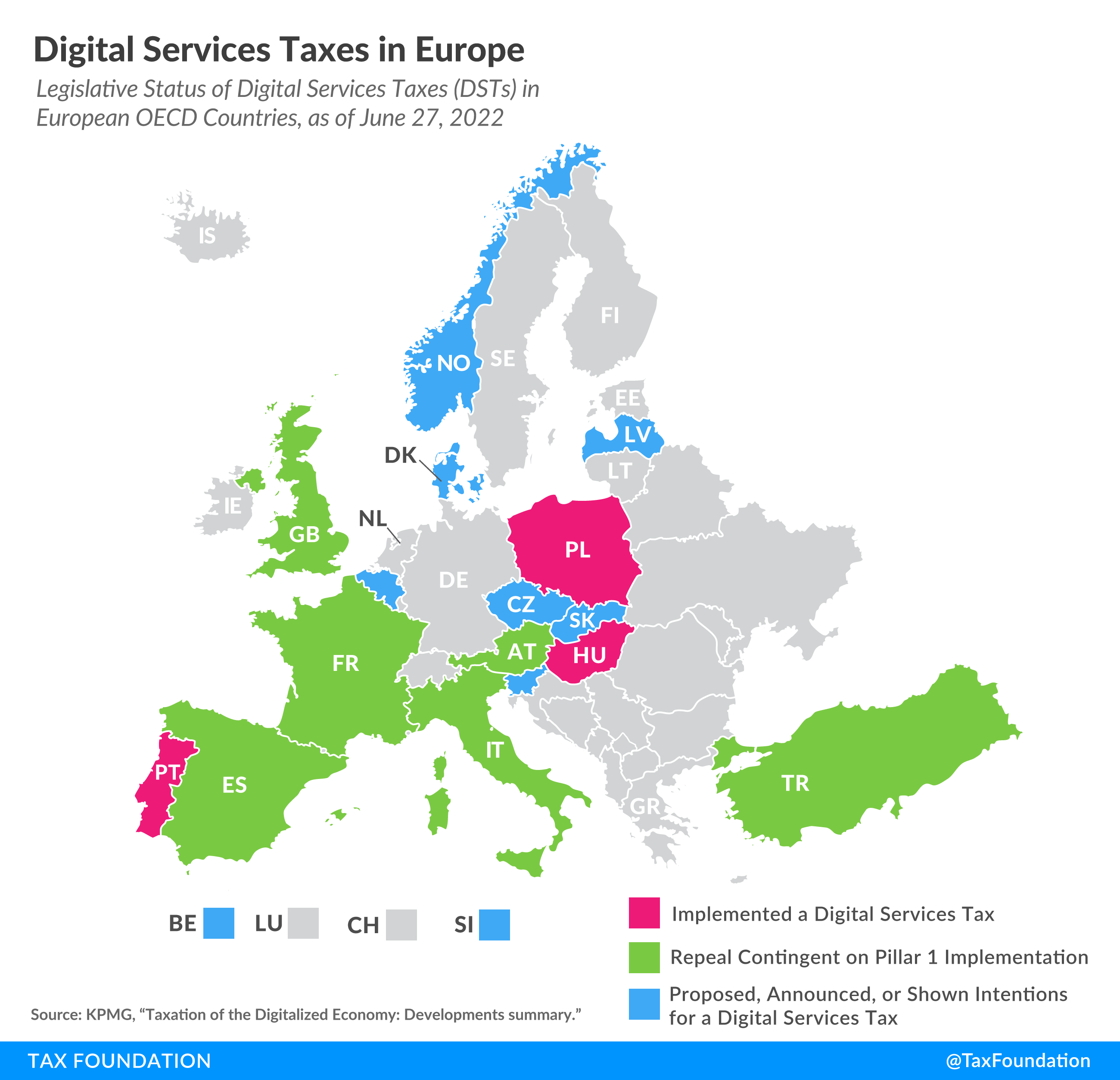

Over the last several years, countries have been adopting novel policies that levy taxes on companies that provide digital services. There are two main problems with these digital services taxes (DSTs). First, they are discriminatory. One common model is to set a revenue threshold high enough that the vast majority of businesses impacted by the tax are foreign companies. Additionally, the policies are targeted at particular business lines (such as online streaming services, digital advertising, and the sale of user data). This violates the principle of neutrality.

Second, they tax companies on gross revenues rather than income. This means that the tax will be owed regardless of whether a particular digital service is profitable.

Because the United States is home to the vast majority of companies impacted by these DSTs, U.S. lawmakers have consistently argued against the policies, including very recently in a letter from Senate Finance Chairman Sen. Ron Wyden (D-OR) and Ranking Member Sen. Crapo (R-ID) about Canada’s proposed DST.

One clear goal for U.S. policymakers has been to eliminate DSTs either through a multilateral agreement (more on this below) or through trade threats and a potential trade war. In 2020, the Trump administration announced 25 percent tariffTariffs are taxes imposed by one country on goods or services imported from another country. Tariffs are trade barriers that raise prices and reduce available quantities of goods and services for U.S. businesses and consumers.

s on $1.3 billion worth of trade with the European Union in response to the French DST. These tariffs had a delayed implementation date and are currently still on hold.

The multilateral negotiation at the OECD has taken a circuitous route to a draft multilateral treaty, but here we are, nonetheless.

One key element of the draft treaty is Annex A, where you will find a list of policies that will be removed once the treaty is adopted. Included in that list are the DSTs of eight countries. The list is not fully inclusive of all discriminatory digital tax policies. But the draft treaty also eliminates the allocation of taxable profits to countries that do not remove policies that fit within the draft treaty’s definition of DSTs and relevant similar measures (see here for the specific language):

- The tax is driven by the location of customers or users.

- It is generally a tax on foreign businesses.

- It is not a tax on income and is beyond agreements to avoid double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income.

.

The incentive to remove a DST other than those already specified will depend on whether a country sees a better tax revenue outcome from Pillar One, Amount A. In turn, those revenue numbers will depend on how the rest of Amount A gets negotiated.

Also, it seems unlikely that these principles will result in “all” DSTs being removed as agreed in October 2021. There is room for governments to work around the principles above. A DST could potentially get past the second principle by applying it to both domestic and foreign businesses in a somewhat balanced way.

2. The treaty will not be adopted without U.S. support.

The draft treaty proposes a points system to determine whether a critical mass of jurisdictions has agreed to the treaty. The entry into force provisions require 30 ratifications and approval by jurisdictions representing a total of 600 points or more. The points ascribed to jurisdictions can be found here. The United States has been assigned 486 points, and there are 999 points available. There is no path to 600 points without approval from the United States, and the U.S. Constitution requires 67 votes in the U.S. Senate to ratify a treaty. This appears to be a rather unlikely outcome at this juncture.

3. Not all countries agree.

There are a couple of reasons that this is a “draft” multilateral tax treaty. One reason is that the U.S. Treasury would like to get public input on it. Another reason is that several countries have expressed objections to the draft proposal.

Brazil, Colombia, and India object to several provisions, including a provision that suggests current taxes applied in market countries should reduce the new opportunity to tax profits allocated under Amount A. This is a question of double dipping (or not). If a country already has the right to tax a business on its activity in a country using withholdingWithholding is the income an employer takes out of an employee’s paycheck and remits to the federal, state, and/or local government. It is calculated based on the amount of income earned, the taxpayer’s filing status, the number of allowances claimed, and any additional amount of the employee requests.

taxes, and Amount A would allocate new taxing rights, should the new right be a gross allocation or a net allocation? In my view, Amount A should not duplicate existing taxation that is happening in market jurisdictions.

Brazil, Colombia, and India seem to agree that it should be a gross allocation with no offset for existing taxes owed. Other countries appear to be aiming for a net allocation where the Amount A taxing right is reduced by existing rights to tax in a market jurisdiction.

4. This is truly a unique (and complex) tax policy.

The draft multilateral tax treaty under Pillar One would rearrange the rights to tax profits of the largest multinational companies. According to the OECD, taxing rights on about $200 billion in profits would be shifted to jurisdictions different from where the profits are currently being taxed. Due to tax differences in current vs. proposed jurisdictions, the changes would lead to a tax increase between $17 and $32 billion, based on 2021 data. In their release, the OECD says their analysis points to revenue gains in low and middle-income countries and losses primarily in jurisdictions often referred to as tax havens.

Treasury Secretary Janet Yellen has suggested in the past that the impact on U.S. revenue is difficult to determine while disagreements remain on the treaty text.

The proposal applies a new set of rules to businesses with more than $200 billion in profits. These proposed rules take 25 percent of profits above a 10 percent profit margin and apply multiple calculations and rules to determine where those profits should be moved from and where they should be taxed under the proposal.

There are formulas for all sorts of things:

- A formula for determining where a company gets relieved from taxation.

- A formula for allocating taxable revenues across jurisdictions.

- A formula for determining a taxable presence in a jurisdiction.

None of these approaches have truly been tested before in international tax policy, which is why last year my colleague and I wrote that the policy seems to be one “that works in theory and may have a slight chance to work in practice.”

5. Nobody knows what will happen next.

The U.S. Treasury has opened a 60-day consultation period for the proposal and is requesting public review and input. Here at Tax Foundation, we’re taking this consultation seriously, just as others in the U.S. tax community are doing.

However, if the U.S. consultation process shows the Treasury that additional changes need to be made, it is unclear whether those changes will be acceptable to other countries. Canada is plowing ahead with its DST, and it is possible that more tariff threats from the U.S. government could be on the horizon.

Hold onto your hats, folks, this ride isn’t over yet.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share