Food-delivery company Wonder Group has gotten a cash infusion from Nestle, as the startup looks to sell high-tech kitchen equipment and prepared ingredients to businesses such as hotels, hospitals and sports arenas.

The deal includes a $100 million investment from Nestle, along with a strategic partnership, according to sources familiar with the matter who asked not to be named because financial terms of the deal are not public.

Nestle and Wonder confirmed the deal but declined to reveal transaction details.

The funding could get Wonder a step closer to its ambitions of making it easier, faster and cheaper for busy families to have high-quality meals at home. The startup, which was valued at about $3.5 billion when it closed a $350 million funding round in June, was founded in 2018 by serial entrepreneur and former Walmart e-commerce chief Marc Lore.

Wonder recently struck a deal to acquire meal-kit company Blue Apron for $103 million. It has also developed kitchen equipment that simplifies and speeds up cooking restaurant-quality food.

Prior to Wonder, Lore founded and sold e-commerce startup Jet.com to Walmart for $3.3 billion in 2016. Walmart ultimately shut down Jet, but Lore oversaw the big-box retailer’s aggressive push into the online world and its race to close the gap with rival Amazon. He left Walmart nearly three years ago.

Lore sold Quidsi, another business he co-founded and the parent company of Diapers.com, to Amazon.

In an interview with CNBC, Lore said working with Nestle will help Wonder scale more quickly.

Nestle, a food and beverage giant, makes ingredients, snacks and frozen meals carried by grocery stores, but also has a large food-service business and sells to clients including college campuses and cruise lines. Some of those companies may also want Wonder’s kitchen equipment, Lore said.

The partnership will start with Nestle making pizza and pasta tailored for Wonder’s kitchen equipment, along with selling the kitchen equipment to clients.

Melissa Henshaw, president of out-of-home for Nestle, said many of Nestle’s clients have struggled to keep up as customers seek convenient meals and bolder flavors, but the businesses lack the employees to make them. In many cases, that’s led to changes that limit sales opportunities and disappoint customers, such as whittled-down room service menus at hotels, limited hours at cafes or food that’s flavorless, soggy or cold.

“With our partnership with Wonder, there’s this opportunity to help operators across multiple out-of-home segments be able to improve their food quality, have consistency, and actually open up some additional revenue streams that have been pretty challenged post-pandemic,” she said.

Wonder began with a very different business model: A fleet of trucks with mobile kitchens that parked and cooked meals outside customers’ homes in the suburbs of New Jersey and New York. It pulled the plug on that approach in January and laid off hundreds of employees in a push to turn a profit quicker.

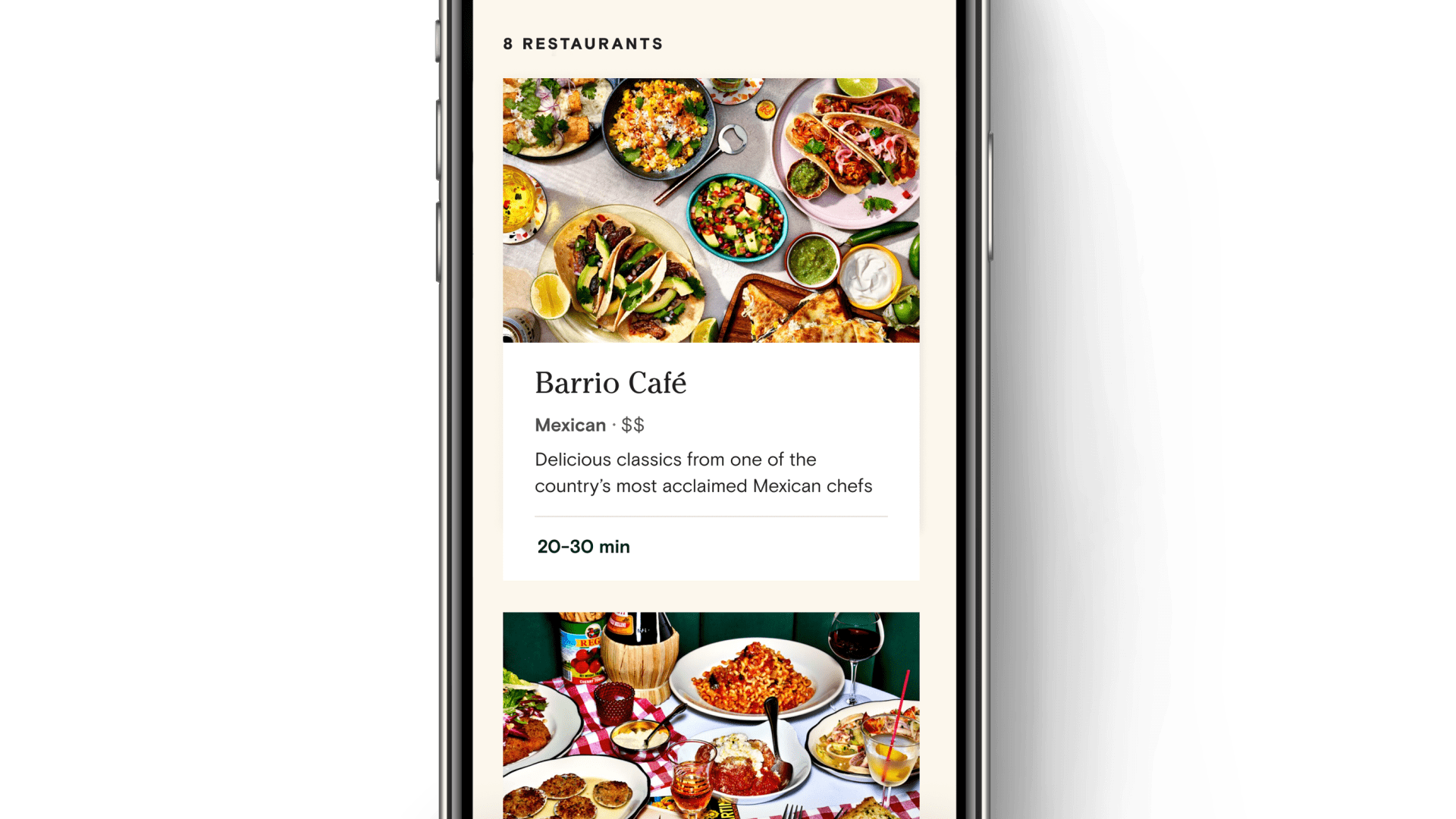

Instead, the startup pivoted to opening a growing network of brick-and-mortar kitchens where it can make menu items across cuisines that customers would otherwise find at restaurants with large followings or celebrity chefs, such as José Andrés, Bobby Flay and Michael Symon. It has bought rights from a growing number of those chefs and restaurants, which allows customers to mix and match — diners could get entrees from four different restaurants for four different family members in a single order.

The company currently has about 1,100 employees.

As of the end of the year, Wonder plans to have 10 locations in the tri-state area of New York, New Jersey and Connecticut. Each of those locations has about a dozen seats where customers can dine in, but the majority of orders are delivered or picked up for at-home dining, Lore said. Next year, it plans to open at least 20 more locations, he said.

With the startup’s new push, Wonder is selling its white-labeled technology and the meal ingredients — specially made and prepared — that goes with it to other businesses. It’s already rolled out the business-to-business offering, called WonderWorks, at 50 locations, including convention centers, theaters and airports.

Ultimately, Lore said he wants Wonder to be a “super app for mealtime” with a variety of tiered options that fit customers’ budgets, dietary preferences and schedules. The choices would include kits from Blue Apron and hot meals from its kitchens.

Wonder competes with a diverse array of players in the food space. They range from delivery companies such as Uber Eats and DoorDash to quick-service restaurants including SweetGreen and Chipotle and even grocers such as Kroger and Amazon-owned Whole Foods, which have expanded prepared food offerings.

Wonder wants to differentiate itself by how it makes that food, so it can prepare a lengthy list of meals and elevate the taste of those menu items, even in a 2,800-square-foot kitchen with little equipment and labor.

“There’s no gas,” Lore said. “There’s no stove. There’s no fire. There’s no hoods. There’s no grease traps. This can go into a shoe store, a yoga studio or LensCrafters. It can go in anywhere. So it allows you to be very, very adaptable with the kitchen.”