It’s the most wonderful time of the year! It’s the third annual anonymous media and entertainment executive predictions list!

In honor of the 12 days of Christmas, I asked 12 past and current executives at the world’s biggest media and entertainment companies for one industry-shaking prediction for 2024. And then I asked one more because this is the holiday season, and I was feeling generous. A baker’s dozen! Actually, I asked a few more, but some overlapped.

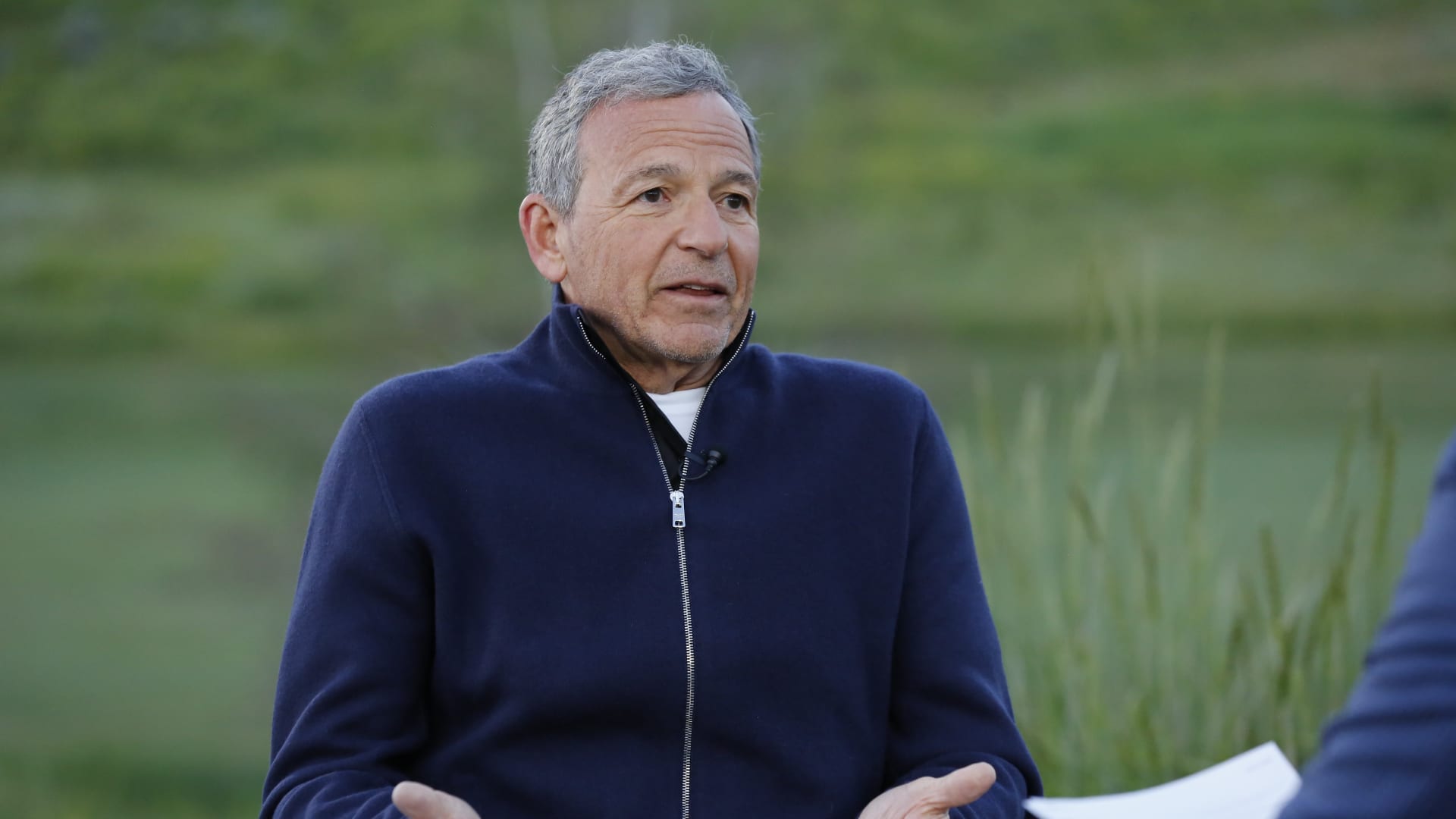

Quite a few of last year’s predictions were accurate. Disney Chief Executive Bob Iger did extend his contract. Christine McCarthy stepped down as Disney’s chief financial officer. Paramount Global hasn’t sold, but controlling shareholder Shari Redstone is now in talks to sell National Amusements. Google’s YouTube acquired the National Football League’s “Sunday Ticket” package.

Some weren’t as good. The media industry didn’t bounce back from recession as well as one executive hoped. Netflix didn’t merge with another company. Apple didn’t ban TikTok from its app store.

Alas, hope strings eternal with a new year.

Executive 1: Comcast will spin off NBCUniversal and merge it with Warner Bros. Discovery

Warner Bros. Discovery is approaching the two-year anniversary of its 2022 merger, when Discovery combined with WarnerMedia. That deadline is important for Reverse Morris Trust tax reasons. Without getting into the boring details, the important part is Warner Bros. Discovery can do another significant deal two years after the close of Discovery and WarnerMedia.

One executive targeted NBCUniversal as the most likely acquirer of Warner Bros. Discovery. This executive predicted Comcast CEO Brian Roberts would spin off NBCUniversal so that the new company would trade separately. But, Comcast (and Roberts) would keep a controlling stake of the ownership of the new entity.

A second executive suggested a more expansive scenario. Comcast will keep its theme parks business but sell the rest of the company in exchange for WBD common shares. Comcast will get a premium for the remainder of NBCUniversal in exchange for Roberts giving up his voting shares. Warner Bros. Discovery CEO David Zaslav runs the combined company, with NBCUniversal film chief Donna Langley staying on to run an expanded studio.

Executive 2: Bob Iger will, again, extend his contract as Disney CEO

Earlier this year, Disney CEO Bob Iger renewed his contract through 2026. Iger has said he actually plans to walk away from Disney forever when his contract is done. Iger has extended his contract as CEO to avoid retirement on five different occasions. Of course, when Iger left at the end of 2022, he said the same thing.

This executive predicted “fool me five times, shame on me.” Disney has many strategic problems that don’t have easy answers, such as figuring out how ESPN’s business fits in a direct-to-consumer world and how to wind down its legacy TV cable networks. Those problems demand a leader with a steady hand who understands the industry. Is there a better leader of Disney than Bob Iger? The Disney board has decided, over and over again, that there is not. Why would this time be any different?

Executive 3: Nelson Peltz and Jay Rasulo will win their campaign to join the Disney board

One thing that may prevent Iger from extending his contract is if Nelson Peltz and Jay Rasulo get board seats. Last week, activist investor Peltz and former Disney Chief Financial Officer Rasulo criticized Disney’s failed succession planning as part of a statement announcing their intentions to run for Disney’s board of directors when nominees are selected next year.

“In our view, Disney’s board has failed to fulfill its essential responsibilities – overseeing the development of an effective strategy, planning for orderly succession, aligning executive pay with performance, and ensuring accountability for operational execution,” Peltz said in the statement.

This executive predicted Peltz and Rasulo will win their campaign and both join the board. A second person guessed only Rasulo will get a spot — perhaps via a settlement before a vote.

Executive 4: Iger will name Dana Walden his successor as Disney CEO

If Iger does leave, he and the Disney board will need to name a successor. I reported in September that Iger plans to name a successor in early 2025 and give that person about 20 months to prepare for the role. If so, an announcement could come in late 2024. This executive predicted it will be Co-chairman of Disney Entertainment Dana Walden who gets the nod. Iger will again move to a chairman role when Walden takes over as CEO, just as he did with Bob Chapek in 2020.

A second person threw out a different name to key an eye on: Andrew Wilson, the CEO of Electronic Arts. This may seem out of left field, but here’s some inside baseball for you — the same executive to mention Wilson correctly predicted Iger would return as Disney CEO in 2022. Then last year, the person said Chris Licht wouldn’t last the year as CNN’s CEO and McCarthy would depart as Disney’s CFO. Three for three! So, maybe pay attention.

Executive 5: Disney will buy Candle Media and Kevin Mayer will position himself as a leading internal candidate to take over for Iger

One last Disney succession prediction! This person predicted Disney would acquire the privately held Candle Media to acquire Moonbug Entertainment, the owner of CoComelon. Disney would then attempt to sell the remainder of Candle Media’s assets at firesale prices, the executive predicted.

Candle Media is co-run by two former Disney executives, Kevin Mayer and Tom Staggs. This person’s guess is Mayer will return to Disney in a senior operating role to position himself as Iger’s top successor candidate while Staggs would leave the company.

Executive 6: NBA rights will go to Disney, Warner Bros. Discovery and Apple

One of the most closely watched media stories of 2024 will be what the National Basketball Association decides to do with its media rights. I reported in October that the NBA ideally wants three media partners with different packages of games.

Disney and Warner Bros. Discovery are the incumbents. Both want to maintain carriage relationships with the NBA, though both companies have also stressed they will be financial disciplined. The league is also looking for a robust streaming option. This is where Apple would fit in. (For what it’s worth, a second executive said he didn’t think Apple would even make a bid for NBA rights and thought NBCUniversal’s Peacock might end up with them.)

Executive 7: The College Football Playoff won’t get the rights fee increase it wants as ESPN will be the only significant bidder

Other than the NBA, the CFP may be the next most important rights deal to be renewed next year. The CFP’s current 12-year deal with ESPN expires after the 2025 playoff.

At that time, the college football playoffs will expand from four teams to 12. That may sound enticing as a new live sports behemoth, but this executive guesses that potential bidders Amazon and Apple will balk at the price CFP wants for the games. ESPN is desperate for live rights as it prepares a direct-to-consumer service and will renew the package, this executive predicts.

Executive 8: Local broadcast stations take most local NBA, NHL and MLB sports rights away from regional sports networks

Sticking with the sports theme, the regional sports network business may or may not be collapsing. Broadcast stations groups have been in talks with the NBA, NHL and MLB for much of the year about picking up local games if certain RSNs fail.

Poaching teams from Diamond Sports Group, which filed for bankruptcy earlier this year and carries the games of more than 40 professional sports teams, has been the primary target thus far for companies such as EW Scripps and Gray Television. Scripps now carries games from the NHL’s Las Vegas Golden Knights and Arizona Coyotes. Gray reached a deal to broadcast the NBA’s Phoenix Suns earlier this year.

The Wall Street Journal reported that Amazon in talks to invest in Diamond Sports Group to keep the company afloat while potentially using Prime Video as a landing home for streaming rights.

This executive said he believes the broadcast station groups will emerge as the primary winner of rights as leagues will push for the expanded reach of broadcast TV while cable subscribers dwindle.

Executive 9: Warner Bros. Discovery’s Max, Netflix and Disney will offer the first significant streaming bundle

Media pundits on CNBC love to say that subscription streaming will eventually be bundled in something that kind of looks like (and is priced like) traditional cable TV.

But years into the streaming wars, this hasn’t happened. No one has emerged as the dominant aggregator. No bundle of many services exists. It’s complicated to get media companies on board to agree to what something like that would look like.

This executive said 2024 will be the year companies finally get serious about bundling, predicting Disney would agree to bundle its trio of streaming services (Disney+, Hulu and ESPN+) with Max and Netflix to offer a selection of streaming services — at a discount — that rivals cable TV.

A second executive noted that such a discount will probably need to be championed by an anchor distributor. This executive’s guess is that it will be Amazon. He also predicted Paramount Global‘s Paramount+ and Warner Bros. Discovery’s Max will be a part of the first streaming bundle that Amazon offers.

Executive 10: RedBird Capital will acquire Paramount Global and name Jeff Zucker CEO

Private equity firm RedBird Capital, founded by Gerry Cardinale, has been stockpiling executive talent, including two former NBCUniversal heads in Jeff Zucker and Jeff Shell, who begins work at the private equity firm in early 2024.

This executive made the bold call that RedBird won’t just acquire Shari Redstone’s National Amusements but all of Paramount Global, backed by a consortium of outside funding, including money from David Ellison and BDT Capital, the private equity firm run by Michael Dell and Byron Trott that backed Redstone earlier this year.

Zucker could then run Paramount Global and do the dirty work of deciding what part of the company he wants to run and what to sell. Still, this executive said Zucker would keep most of the assets and attempt to prove the company was undervalued as a publicly traded entity.

Executive 11: CNN will let go of one of its top anchors as it redirects money to digital

No matter how great CNN makes its programming, the cable news giant probably can’t defeat the bigger secular forces of declining cable subscribers. That will mean less money coming in the door for new CEO Mark Thompson, who plans on investing more in digital.

This executive predicted CNN won’t be able to up its digital spending without cutting back on a declining linear TV business — and that will mean letting go of at least one of its big-name anchors to save cash.

The move will usher in a new era at CNN, where star anchors are no longer the focus of the company.

Executive 12: Linda Yaccarino won’t last the year as CEO of X

Former NBCUniversal advertising chief Linda Yaccarino joined X as its new CEO in 2023, but the fit at the company seems to make less and less sense by the day as advertisers flee.

Yaccarino suffered through an awkward interview with CNBC’s Julia Boorstin earlier this year when Boorstin asked her if she was a CEO “in name only” and was only at the company to do owner Elon Musk’s bidding.

This executive predicted Yaccarino would either lose patience or find her job increasingly pointless and leave the company in 2024.

Executive 13: No movie will top $1 billion at the box office all year

For the first time in more than 15 years, not counting 2020’s pandemic shutdown, no movie will top $1 billion at the box office, this executive predicted. (This year, “Barbie” and “The Super Mario Bros. Movie” each easily cleared $1 billion, while “Oppenheimer” came in just shy at around $950 million.) Universal’s “Despicable Me 4” has the best chance, this person said. But predicting only “Despicable Me 4” would top $1 billion isn’t as bold, and you only live once … anonymously.

Happy holidays!

Disclosure: Comcast is the parent company of NBCUniversal, which owns CNBC.

WATCH: It’s very hard to see any strategic buyers of Paramount Global, says LightShed’s Greenfield