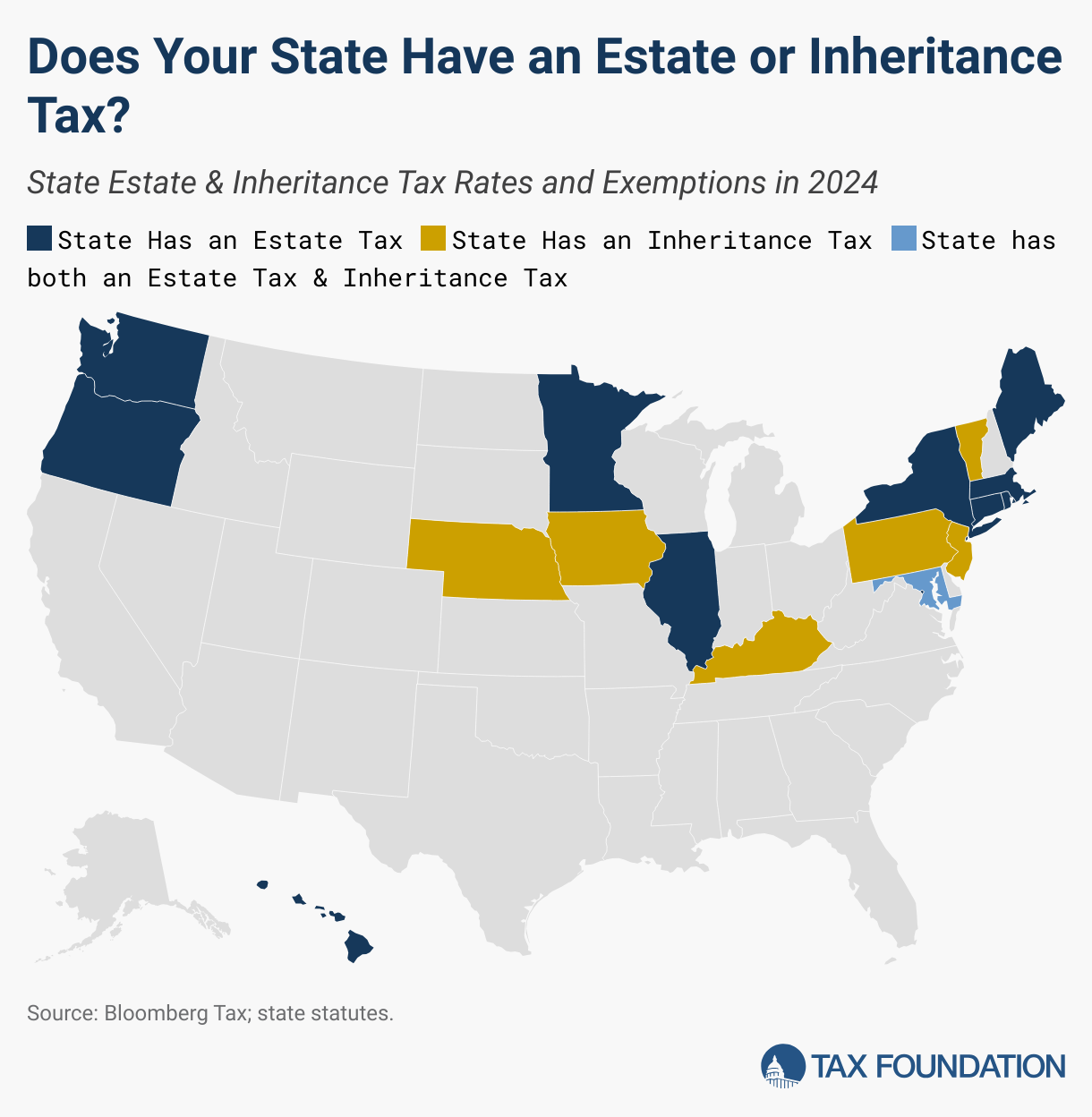

Estate and inheritance taxes are burdensome. They disincentivize investment and can drive high-net-worth individuals out of state. They also yield estate planning and tax avoidance strategies that are inefficient, not only for affected taxpayers but also for the economy at large. The handful of states that still impose them should consider gradually eliminating them or at least conforming to federal exemption levels.

Under the Tax Cuts and Jobs Act (TCJA) of 2017, the federal estate tax exemptionA tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the Internal Revenue Service (IRS), preventing them from having to pay income tax.

was raised from $5.49 million to $11.18 million per person, with inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power.

adjustments (in tax year 2024, the federal exemption is $13.61 million), though this provision expires December 31, 2025. Connecticut is the sole state that pegged its state estate tax exemption threshold to the federal threshold for tax year 2024. New York has the second-highest exemption by excluding $6.94 million from its unusually high-rate estate tax.

Six states assess an alternative tax on bequests, known as the inheritance tax. New Jersey and Kentucky have the highest top marginal rates at 16 percent. Iowa is in its final year of phasing out its inheritance tax, and its rates currently range from 1 percent to 2 percent on inheritances valued between $12,500 and $150,000. This is a significant decrease since its top marginal rate was capped at 6 percent in 2023.

Because estate taxes in particular encourage wealthy individuals to move out of state—depriving the state of tax revenue that would have been generated during their lifetimes—many states eliminated their estate tax following federal law changes in the 2000s, and some are engaging in current legislative discussions about reforms to their estate and/or inheritance taxes. Connecticut, Iowa, Massachusetts, Minnesota, New York, Oregon, and Washington all featured legislative discussions surrounding changes to these taxes in 2024.

Prior to 2005, the federal government incentivized states to assess state-level estate taxes by offering a federal credit against state estate taxes. This made estate taxes an attractive option for states since taxpayers were paying the same amount in estate taxes whether their state levied the tax or not. After the federal government fully phased out the state estate tax credit in 2005, some states stopped collecting estate taxes by default, as their provisions were directly linked with the federal credit, while others responded by repealing their tax legislatively.

2024 Notable Changes

- Iowa reduced continued to reduce its inheritance tax rate from 5 percent to 1 percent in 2024.

- New York increased its exemption threshold by $360,000 from $6.58 million to $6.94 million in 2024.

- Maine increased its exemption threshold by $390,000 from $6.41 million to $6.8 million in 2024.

- Connecticut aligned with the federal exemption threshold of $13.61 million in 2024.

Particularly after 2005, most states have been moving away from estate or inheritance taxes or have raised their exemption levels, as these taxes hurt states’ competitiveness and create incentives to avoid paying them, especially for wealthy taxpayers. Delaware repealed its estate tax at the beginning of 2018. New Jersey finished phasing out its estate tax at the same time, and now only imposes an inheritance tax. Vermont finished phasing in an exemption increase in 2021, bringing the exemption to $5 million that year, compared to $4.5 million in 2020. Maine increased its threshold by the highest percentage, relative to 2023 values, boosting the exemption threshold by 5.7 percent in 2024. Connecticut also finished phasing in an increase to its exemption, matching the federal estate tax exemption, and simultaneously transitioned to the flat tax rate.

In two more states, Hawaii and Illinois, attempts to eliminate (Hawaii) or reform (Illinois) the estate tax fell short in 2024.

Four of the six states with inheritance taxes—Kentucky, Maryland, New Jersey, and Pennsylvania—structure their inheritance taxes such that the rate structure varies based on the proximity of the bequest recipients to the decedent. States with this proximity test give preferential treatment, usually lower rates or higher exemption thresholds, to immediate family members while taxing those further away from the decedent at higher rates. The 12 states that impose estate taxes increase the burdens for generational wealth transfers which can reduce economic growth due to this unnecessary tax. These states should consider ways to eventually phase out and eliminate this tax to promote the stability of family businesses, reduce transaction costs, and prevent government overreach during an already difficult time for the friends and family of the deceased.