Key Findings

- The global minimum taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

agreement known as Pillar Two is intended to curb profit shiftingProfit shifting is when multinational companies reduce their tax burden by moving the location of their profits from high-tax countries to low-tax jurisdictions and tax havens.

. However, OECD countries already have a variety of mechanisms in place that seek to prevent base erosion and profit shifting by multinational corporations. - Tax systems generally face tradeoffs between exempting foreign activity from domestic taxation, protecting the domestic corporate tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates.

from profit shifting, and creating a simple system. - Pillar Two limits the ability of countries to compete for shifting profits with low statutory rates. However, countries will still have the incentive and ability to attract profit shifting through other means. As a result, base erosion measures may still be necessary.

- Pillar Two implementation risks of adding a rigid but relatively ineffective layer to the already complex series of anti-avoidance measures, or alternatively, becoming a project without end and subject to constant litigation.

- Policymakers should identify overlapping anti-avoidance measures and aim to reform or eliminate redundant policies to avoid ever-increasing complexity for cross-border tax rules.

Introduction

During the last ten years, many countries adopted changes to close off several avenues that multinationals could previously use to minimize their corporate tax burdens. These changes effectively increased taxes on companies by limiting avoidance opportunities. The changes were limited tax arbitrage through statutory corporate rate differentials, gaps in legal entity definitions, and tax minimization avenues afforded by tax treaties.

The avoidance scenarios were mostly well-defined, and the policy levers were targeted to specific circumstances.

However, now many countries are moving forward with a global minimum tax that also seeks to close off avenues to corporate tax minimization by multinational companies.

While the exercise in the 2010s was about targeted anti-avoidance regimes, the Pillar Two global minimum tax takes a much broader approach without targeting any specific avoidance strategy. The previous rules were micro targeted; the global minimum tax is macro targeted.

This creates a question for policymakers. Once the minimum tax rules are adopted, how should the burden of the rules from the previous decade be addressed?

As the Organisation for Economic Co-operation and Development (OECD) pointed out in May 2022,[1]

“Against the backdrop of the Two-Pillar Solution and other changes to the international tax landscape, countries should eliminate or modify existing rules and measures addressing essentially similar risks which have become duplicative.”

What governments were addressing with new anti-avoidance rules since 2015 was the risk of under-taxation of profits. Now that countries have agreed to a global minimum tax with an effective rate of 15 percent, the under-taxation problem is being addressed with a single, macro set of rules rather than a handful of micro rules.

As the minimum tax rules come into effect, governments should begin removing or amending other anti-avoidance regimes. This paper provides a framework for understanding anti-avoidance rules and evaluating them in light of the Pillar Two global minimum tax.

What Is the Purpose of Anti-Avoidance Rules?

In recent decades, most OECD countries have adopted what is known as a territorial corporate tax system, where foreign earnings of multinational corporations are generally exempt from domestic taxation. These systems allow multinational enterprises (MNEs) to invest and earn profits and remit those profits to domestic shareholders with little or no extra taxation at the entity level. In most cases, territorial tax systemA territorial tax system for corporations, as opposed to a worldwide tax system, excludes profits multinational companies earn in foreign countries from their domestic tax base. As part of the 2017 Tax Cuts and Jobs Act (TCJA), the United States shifted from worldwide taxation towards territorial taxation.

s provide a full or partial exemption for foreign profits through a “participation exemption.”

A territorial system makes a country’s own MNEs more competitive abroad than its counterpart, a “worldwide” or residence-based system. The territorial system leaves its national champions free to compete abroad, paying taxes only to each jurisdiction they operate in. By contrast, the worldwide system adds another layer of tax to its home country in addition to the jurisdiction the MNE is operating in. The competitive advantages of a territorial system are a critical reason why it has gained favor in recent years. Even systems that are not fully territorial—such as that of the United States—have moved substantially towards territoriality, with considerably lower rates on foreign profits than on domestic profits.

Territorial systems are not, however, without drawbacks. Territorial systems hinge on where production is located, which is increasingly difficult to define in an increasingly digitalized world. Production processes can stretch across multiple jurisdictions, or take place largely on the internet, or involve “intangible” factors of production like brands or patents. Furthermore, they can include transactions within a MNE group. These transactions lack the motivated self-interest that defines deals between unrelated parties. As a result, they may be unreliable guides to a reasonable apportionmentApportionment is the determination of the percentage of a business’ profits subject to a given jurisdiction’s corporate income or other business taxes. U.S. states apportion business profits based on some combination of the percentage of company property, payroll, and sales located within their borders.

of profits among jurisdictions.

MNE groups have an incentive to take advantage of this ambiguity and allocate profits among jurisdictions in a way that minimizes their tax liabilities, often by locating more of their profits in jurisdictions with lower domestic tax rates. If the MNE group is headquartered in a territorial country, it may be incentivized to locate some of its domestic profits abroad in low tax jurisdictions. Conversely, jurisdictions have an incentive to reduce taxes in order to attract the mobile income of MNEs.

This problem has been acknowledged for many years, and countries have adopted methods of curbing base erosion due to profit shifting, including Controlled Foreign Corporation (CFC) rules, limitations on interest deductibility, and other similar measures.

While CFC rules were first adopted in the United States in 1962, many significant base erosion measures are products of the last ten years.[2] In 2013, the G20 proposed that the OECD pursue an agenda to minimize base erosion and profit shifting (BEPS). Following the BEPS recommendations in 2015, many countries have adopted anti-base erosion measures. Additionally, in 2017, the U.S. moved towards a territorial system but created new base erosion measures, such as the tax on Global Intangible Low-Taxed Income (GILTI)Global Intangible Low-Taxed Income (GILTI) is a special way to calculate a U.S. multinational company’s foreign earnings to ensure it pays a minimum level of tax. GILTI was adopted as part of the 2017 Tax Cuts and Jobs Act (TCJA) and can lead to high tax burdens on foreign profits, putting U.S. companies that operate abroad at a disadvantage.

and the Base Erosion Anti-Abuse Tax (BEAT). Finally, Pillar Two, a currently ongoing effort, would establish a 15 percent minimum tax globally.

Pillar Two may, if effective, ensure that MNEs pay at least a 15 percent effective tax rate on their income, but its rules may be vulnerable to abuse. Furthermore, jurisdictions would still have a strong incentive to attract shifting profits, even if they are deprived of the most obvious tool—a statutory rate below 15 percent—of doing so. They will compete on other measures, ones not directly interpreted as tax reductions by Pillar Two’s accounting.

If Pillar Two remains rigid in its rules, jurisdictions interested in attracting profit-shifting will find a way around those rules. But the alternative—that Pillar Two remains in a state of continued negotiation and litigation, with new rules promulgated every few years—seems no better.

While base erosion policies typically have reasonable rationales, they risk creating ever-escalating layers of complexity over what ultimately amounts to a small amount of income. Ultimately, in a typical advanced economy, capital income is a small minority of GDP, corporate income is but one type of capital income, and the portion of corporate income that is attributable to the highly mobile “intangibles” of a global MNE is a small fraction of corporate income.[3] And the rules governing this fraction of a fraction of a fraction are likely to remain ham-fisted and unfinished for decades.

There is virtue in simplification, in harmonizing base erosion rules across many countries. But there is also virtue in flexibility, allowing individual governments to see what works. For better or for worse, Pillar Two largely opts for the former.

This report will show that minimum taxes are only one form of anti-avoidance policy, and many other base erosion measures will still have a place in a post-Pillar Two world. However, it will also note areas where current base erosion measures could be folded into, combined with, or replaced by their Pillar Two equivalents.

Territoriality and Anti-Avoidance Rules on the Eve of Pillar Two

Throughout the world, countries have taken varying approaches to adopting the types of anti-avoidance rules above. Prior to Pillar Two, countries had agreed to common approaches and minimum standards that are now reflected in anti-erosion regimes across the developed world. This paper will briefly summarize some of the main approaches and their rationales, and then compare at a more detailed level the anti-avoidance regimes of members of the OECD.

The downloadable appendix tables provide high-level information about the policies in each area.

At a Glance: Base Erosion Measures and their Purposes

|

Policy Type |

Purpose |

|

Blended CFC Rules |

Impose tax on foreign earnings of domestic companies, typically with credits for foreign taxes paid. Reduce the incentive to move earnings out of home country. |

|

Blacklists/Country-by-Country IIR |

Directly override low taxes in a specific country through denial of deductions or top-up tax. |

|

Interest deduction limitations |

Combat incentive to deduct interest expense in high-tax countries and receive interest in low-tax countries. |

|

Other deduction limitations (e.g., BEAT) |

Combat incentive to deduct payments for highly mobile income types from home country profits. |

|

Exit taxes |

Prevent easy shifts of intangibles across jurisdictions. |

|

Transfer pricing regulations |

Curb the use of unreasonable prices in transactions between two entities in the same MNE group. |

|

Patent Boxes/FDII |

Use lower rates for highly mobile income in order to compete with low tax countries. |

Some major categories of base erosion measure are noted in the table above.

One category, CFC rules or other forms of global taxation by the MNE’s ultimate residence, can make profit shifting out of the home country less attractive, because global income taxed at low rates in the foreign jurisdictions still incurs tax by the home country. Often, with credits for foreign taxes paid, these regimes are comparatively lenient on countries with moderate tax rates and comparatively strict on countries with low tax rates. They become especially strict on low-tax jurisdictions when they use country-by-country calculations or even blacklists.

Another broad category of base erosion measure is an arithmetic approach: identifying deductions associated with profit-shifting, and then limiting excessive use of them. For example, high interest payments reducing taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income.

can trigger “thin cap” rules. In the U.S. BEAT system, a wider variety of payments, such as royalties, are involved in the calculation.

A third broad category is exit taxes or other provisions that take effect upon moving assets or income from one place to another. While these may make profit shifting more difficult going forward, they may add complexity and freeze legacy arrangements in place, even if those legacy arrangements do not reflect economic fundamentals. In other words, they may make it harder to “un-shift” profits.

A fourth category is transfer pricing regulations, which attempt to qualitatively assess transactions within a MNE group and reject those that are distorted for tax purposes.

Finally, a fifth category is low-tax provisions for highly mobile income within countries that otherwise have moderate tax rates—in other words, accepting the reality of tax competition on mobile income and attempting to win that mobile income back with lower taxes.

Specific country approaches to these measures follow below with more details in the appendix tables on this paper’s web page.

Participation Exemptions and Dividend Deductions

As mentioned previously, countries enact territorial tax systems through what are called “participation exemptions” or dividend deductions. Participation exemptions eliminate the additional domestic tax on foreign income by allowing domestic companies to either ignore foreign income in the calculation of their taxable income or to deduct foreign income when it is paid back to the domestic parent company. Participation exemptions can also apply to capital gains. Companies that sell their shares in a CFC and realize a gain may face no domestic tax on those gains.

Some countries, such as Luxembourg, grant full exemptions for both foreign capital gains and foreign dividend income earned by domestic corporations. Other countries offer exemptions for one type of income, but not the other. Estonia, for instance, offers a full exemption for dividend income received from foreign subsidiaries (when certain requirements are met). Capital gains are only taxed when a distribution is made.

Of the 38 OECD member countries, 35 countries offer some exemption or deduction for dividend income, 31 countries offer an exemption for capital gains, and 30 countries offer an exemption or deduction for both. Chile, Korea, and Mexico provide neither an exemption for capital gains nor dividends.

Participation exemptions also range from full to partial deductibility or excludability. For example, France exempts 95 percent of foreign dividend income and 88 percent of foreign capital gains. Countries providing partial exemptions often do so because it is less complex than accounting for business expenses that don’t directly correlate to physical production. Usually, companies are required to allocate overhead costs of their headquarters, such as office supplies, to foreign subsidiaries. Allocating these costs can be complex. So instead of writing rules requiring companies to allocate expenses, countries allow companies to deduct those costs domestically but tax a small portion of their foreign profits instead.

Limitations to Participation Exemptions

While most countries have enacted participation exemptions to eliminate the domestic tax on foreign profits, these exemptions are not unlimited. Countries have a range of rules that determines whether foreign profits are subject to tax when repatriated or paid back to their domestic parent.

Many European Union member states offer exemptions only when the resident company holds at least 10 percent of the subsidiary’s share capital or voting rights for some specified period. France and Germany are notable exceptions, with France requiring only a 5 percent holding, and Germany unconditionally exempting 95 percent of foreign dividends and capital gains.

In the case of the United States, the participation exemption adopted in 2017 is limited to dividends received by corporations that are 10 percent owners of foreign corporations (U.S. shareholders) according to the tax code. The foreign portion of the dividend is allowed as a deduction. However, the exemption does not apply to “hybrid dividends,” payments that are treated as tax-exempt dividends in the United States but deductible payments (such as interest) in another jurisdiction.

Some countries also limit participation exemptions and dividend deductions based on a foreign subsidiary’s location. EU member states typically limit exemptions to subsidiaries located in other EU member states or within the European Economic Area (EEA). Some countries publish a “blacklist” of jurisdictions where the tax regime is considered abusive and will not provide exemptions to profits earned in those jurisdictions. Others, such as Norway, impose a standard where a company needs to conduct real business activities abroad to qualify for a participation exemption. This directly excludes holding companies and other kinds of passive operations from receiving an exemption.

Some countries have restrictions based on the line of business a foreign subsidiary is in. For example, several countries that exempt most dividend income will not exempt profits derived from certain service-based subsidiaries such as law offices.

More detail on these rules for OECD countries can be found in Appendix Table 1.

Controlled Foreign Corporation Rules

CFC rules generally outline policies for taxing the undistributed income of a domestic corporation’s foreign subsidiaries. This means that if a foreign subsidiary of a domestic parent corporation is deemed a CFC and subject to a country’s CFC rules, all or a portion of its profits are immediately subject to domestic tax. The income can either be taxed separately from domestic income or incorporated into the taxable base of the domestic parent corporation.

For example, a British corporation may own a subsidiary located in the Cayman Islands. If the British CFC rules determine that the Cayman subsidiary is a CFC and the Cayman effective rate is 75 percent or less than what would be owed under British tax rules, the Cayman subsidiary’s profits then will immediately be taxed in the United Kingdom.

CFC rules are very common throughout the OECD. Only Switzerland and Costa Rica do not have any formal CFC rules. Though some OECD countries enacted CFC rules in the 1970s, most enacted or modified their rules following the recommendations from the OECD BEPS project in 2015.[4] Since 2014, 12 OECD countries have adopted new CFC legislation.

Some countries often have other more qualitative base erosion provisions that attempt to accomplish the same goal as CFC rules. For example, Belgium’s CFC rules only apply to companies that are non-genuine arrangements. This requires the tax authority to determine whether the activities of a foreign subsidiary are connected to real business operations or if the entity exists simply for avoiding taxes.

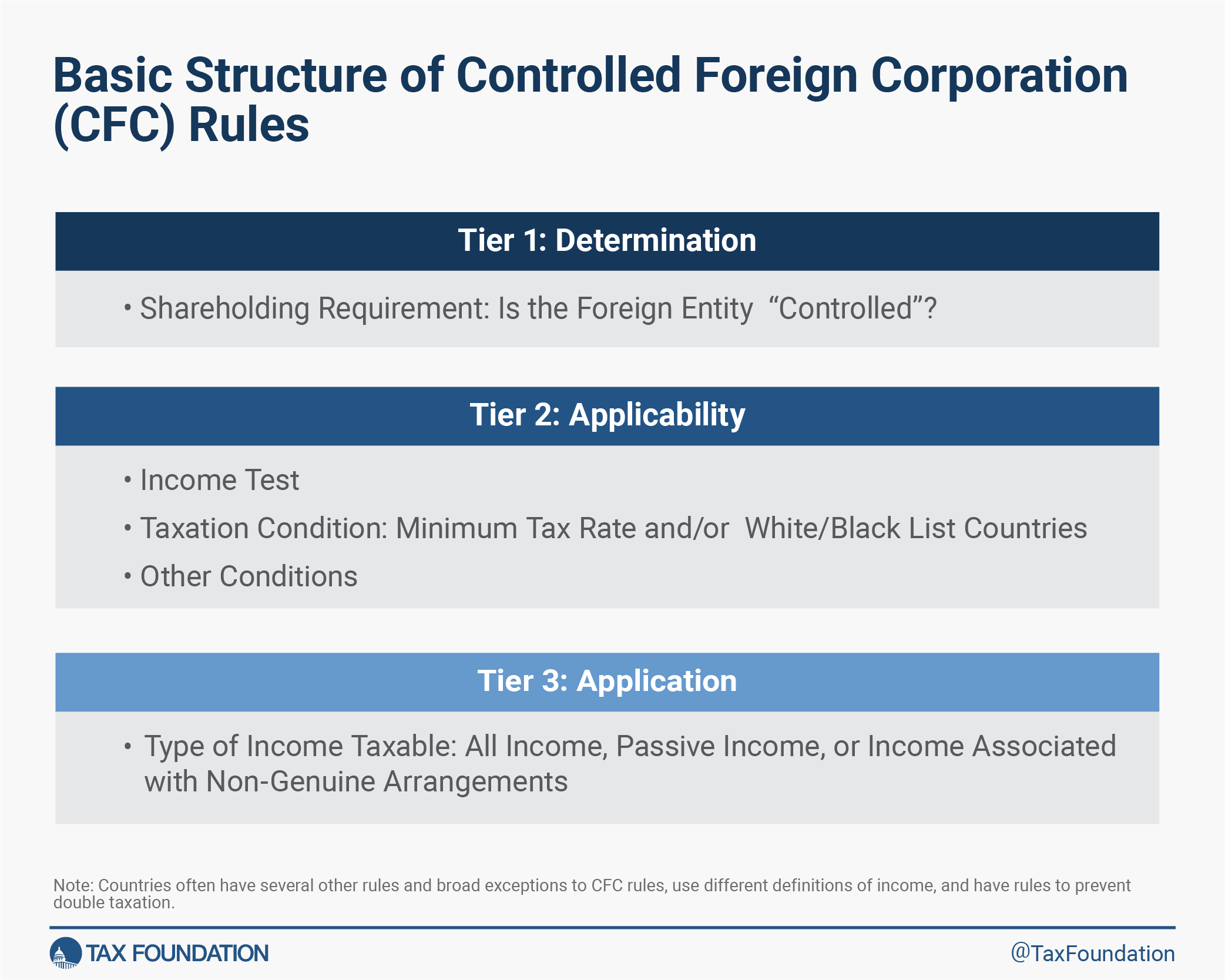

Basic Structure of CFC Rules

CFC rules, while complicated and highly variable, all follow a common outline. First, an ownership threshold or test is used to determine whether an entity is considered a CFC. Next, a second tier of standards is used to determine if the CFC is taxable in the parent company’s country. Finally, the rules determine what types of income are taxable.

Tier 1: Determination

The first set of rules is meant to determine whether a foreign corporation is “controlled.” The idea is that if a foreign company isn’t controlled by a domestic corporation, the domestic corporation isn’t necessarily responsible for profit shifting that may be occurring. What constitutes control varies by country and some countries have ownership thresholds that more easily trigger CFC status than others.

The most common standard is a 50 percent ownership threshold; 30 OECD countries use this standard. If one or more related corporations together own more than 50 percent of a foreign corporation’s shares, that corporation is considered a CFC.

Some countries additionally utilize a single-ownership test to determine when a shareholder of a CFC is subject to additional tax liability. A South Korean shareholder of a CFC is only taxed on CFC income if they own more than 10 percent of its share capital. Similarly, a U.S. shareholder must own 10 percent of a CFC before facing tax liability on CFC income either through Subpart F or GILTI. Of the OECD countries with CFC rules, five employ a separate single-ownership test for triggering tax liability.

Other countries, such as New Zealand and Australia, use an either-or-approach. In both countries a foreign entity is deemed “controlled” if either a single company owns more than 40 percent of the shares or five or fewer related entities own more than 50 percent of the shares. Israel has a similar rule where if a single owner owns 40 percent and together with a relative owns more than 50 percent, the foreign entity is deemed “controlled.”

Some countries use more qualitative assessments to determine CFC status. Mexico considers any foreign corporation where domestic entities have “management control” to be a CFC, and Chile considers foreign corporations to be CFCs when a domestic company has the unilateral power to alter the foreign corporation’s bylaws. New Zealand and Australia also use a qualitative control standard.

Tier 2: Applicability

While many foreign corporations might qualify as a CFC, not all will be subject to domestic taxation. There are generally two ways in which countries determine whether CFC income is taxable by domestic tax authorities.

The first way is through a “taxation condition.” This standard is aimed at preventing profit shifting to low-tax jurisdictions, or “tax havens.” The classification of tax havens is usually based on the effective corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax.

rate levied against the CFC or a “black” or “white” list. Generally, a standard threshold is utilized to determine if the tax rate in the CFC’s country of residence encourages tax avoidance.

The threshold can either be an arbitrarily determined rate or a metric comparing the CFC’s taxation abroad to the treatment it would receive as a domestic enterprise. For instance, Mexico enforces CFC restrictions if the CFC pays an effective rate that is less than 75 percent of the rate that would be paid under Mexican tax rules. Twenty-nine countries subject CFCs to regulation based on a taxation condition.

The second way in which countries determine whether CFC income is taxable is by analyzing the type of income earned by a CFC. There are two main categories that business income can fall into: active and passive. Active income arises from traditional production activities, whereas passive income comes from legal or financial activities that do not necessarily require the participation of the person who receives the income. Passive income in most countries usually includes interest, dividends, rental income, and royalty income.[5] Countries that use income tests typically tax CFCs if most of their revenue is derived from passive income.

Eighteen countries use the percentage of total income derived from passive sources as a benchmark to determine whether CFC rules apply to an entity. The benchmarks diverge enormously. New Zealand applies CFC rules if passive income is greater than 5 percent of total CFC income, whereas Hungary applies CFC rules if passive income is greater than 50 percent of total CFC income.

A few countries also have further conditions they use to determine what income from a CFC is taxable. The United Kingdom has several tests it uses, including length of share ownership and the foreign company’s profit margin. Colombia deems 100 percent of earnings as passive if passive earnings exceed 80 percent of CFC earnings. However, if more than 80 percent of earnings are active, then 100 percent of earnings are deemed active.

Tier 3: Application

Once a country’s CFC rules determine that a company’s CFC’s income is taxable domestically, the rules then define what income is subject to tax. These rules also vary significantly and can apply to a share of passive income or both active and passive income. Of the countries with CFC rules, 15 only tax passive income earned by CFCs while 13 impose taxes on both active and passive income of CFCs. The rest of OECD countries with CFC rules either generally tax CFC income in proportion to passive income (while in some cases capturing some active income) or tax all income of CFCs that are clearly used for the purpose of limiting tax liability (non-genuine arrangements).

Additional Rules and Exemptions

In addition to these general rules, nearly every country has exemptions that determine when a CFC may not be subject to these rules or taxation at all. For example, the EU Constitution contains freedom principles to facilitate business operations between member states (including the case of freedom of movement and freedom of establishment).[6] The European Court of Justice has ruled that CFC rules should only target wholly artificial arrangements within the EU to avoid infringing upon these freedoms.[7] With the EU Anti-Tax Avoidance Directive (ATAD), EU countries have designed rules that exempt CFC income from taxation when they operate in other EU and European Economic Area (EEA) countries and the CFCs are engaged in real economic activities. In addition to the real economic activities rule, some EU members also require a signed tax treaty with the other EU member country for the CFC exemption to apply.

Besides exemptions, countries also have provisions that seek to prevent the double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income.

of income that has already been taxed through a CFC rule when that income is repatriated to its parent company.

Appendix Table 2 has more details on the structure of CFC rules.

Interest Deduction Limitations

Under most tax systems throughout the world, the interest corporations pay on loans and bonds is deductible against taxable income, while interest income is taxable. It is common practice for a multinational corporation to lend itself money, by providing loans to and from subsidiaries located in foreign countries. These cross-border loans are helpful for companies to expand and make new investments in foreign markets.

However, as with other deductible expenses, interest deductions can be used to exploit cross-country differences in corporate tax systems to reduce corporate tax liabilities. Multinational corporations have an incentive to take out loans in high-tax countries (where they can take deductions) and lend from low-tax countries (where they can realize interest income), resulting in a lower worldwide tax burden.

Interest deduction rules can be seen as supplemental to CFC rules. CFC rules apply only to resident corporations whereas interest deduction limitations apply to all corporations—foreign and domestic.

To combat potential abuse of interest deductions, countries place limitations on these expenses. Thirty-seven of the 38 OECD nations place some sort of formal limitation on interest expense deductions. The only country that does not have any widely applicable limitation on interest deductions is Israel. Most of the EU members modified their regimes and included an interest expense limitation rule due to the application of ATAD. In the United States, the rules governing interest deduction limitations were tightened by the Tax Cuts and Jobs Act (TCJA)The Tax Cuts and Jobs Act in 2017 overhauled the federal tax code by reforming individual and business taxes. It was pro-growth reform, significantly lowering marginal tax rates and cost of capital. We estimated it reduced federal revenue by .47 trillion over 10 years before accounting for economic growth.

with a new business interest limitation rule that resembles the OECD parameters established in BEPS Action 4.

Interest deduction limitations are often implemented through rules specifically targeted at multinational corporations, called thin capitalization rules.[8] Thin capitalization rules target companies whose debt levels far exceed equity. Most of these rules are designed to apply when a company has a debt-to-equity ratio beyond a predetermined threshold. Of the 37 OECD nations which currently operate interest deduction limitation rules, 16 employ this method. In some cases, tax authorities also use the debt-to-equity ratio on assessments to evaluate whether interest deductions can be restricted.

In recent years, countries have introduced much broader interest deduction limitations. These limits are sometimes called “earnings stripping” rules and restrict interest deductions to a set percent of income. The standard was set up by the OECD in the BEPS project and made mandatory by the application of ATAD to all EU members. The general standard was to limit interest deductions beyond 30 percent of earnings before interest, taxes, depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment.

, and amortization (EBITDA) with a €3 million de minimis threshold for deductible interest expenses.

Twenty-nine countries have rules generally based on that OECD approach. The United States is one of these countries and adopted a similar rule as part of the TCJA in 2017. Beginning in 2022, however, interest deductions for U.S. companies are limited to 30 percent of EBIT rather than EBITDA. This represents an even broader limitation on interest deductibility.

A few countries with debt-to-equity-style thin capitalization rules also pair them with earnings stripping rules. Eight OECD countries with thin capitalization requirements also use an earnings stripping rule, with Belgium employing this restriction in conjunction with a debt-to-equity ratio.

See Appendix Table 3 for more information on interest deduction limitations for OECD countries.

Transfer Pricing Regulations

Another common strategy in tax planning that can lead to base erosion is abuse of transfer pricing rules. Transfer pricing abuse occurs when a multinational enterprise sells itself goods and services, at an inflated price, from a subsidiary in a low-tax jurisdiction to the parent or another subsidiary in a high-tax jurisdiction. The taxable profits in the high-tax jurisdiction are reduced by these inflated costs, and a portion of those profits is shifted to the low-tax jurisdiction. To prevent this, countries almost uniformly demand that transactions between related parties are conducted at arm’s length, or “priced as if the enterprises were independent…and engaging in comparable transactions under similar conditions and economic circumstances.”[9]

While countries have broad authority to impute tax liability for transactions deemed to be in violation of the arm’s length principle, documentation requirements on the transacting firms can be helpful to tax authorities in identifying potential profit shifting risks and act as a deterrent for multinationals to engage in profit shifting.

The additional transfer pricing rules require companies to justify more consistently and clearly how they determined the price at which they would be providing themselves a product or service in a cross-border transaction. These regulations can partially reverse the activities that businesses previously undertook to minimize their tax burden through transfer pricing. These rules have been implemented in various forms including master and local file documentation of transfer pricing practices. Seventeen OECD countries had requirements for filing both master and local documentation as of 2017.[10]

Other Anti-Base Erosion Provisions

Several countries have additional rules to prevent base erosion. Many of these policies have been adopted relatively recently, and some of these new provisions were developed as part of the OECD’s BEPS project.

Countries including Australia, Germany, the United Kingdom, and the United States have introduced unique anti-base erosion provisions. See Appendix Table 4 for other information about these rules.

Australia: Multinational Anti-Avoidance Law and Diverted Profits Tax

Australia has an additional anti-base erosion provision, titled the Multinational Anti-Avoidance Law (MAAL), which allows the Australian Taxation Office to impose penalties of up to 120 percent of the amount of avoided tax under certain circumstances. The MAAL has been in effect since 2016 and applies to significant global entities (SGEs), multinational businesses with global revenues of $1 billion AUD or more or an entity which is part of a multinational group with at least $1 billion AUD in global revenue. The MAAL penalty applies to business structures or transaction arrangements for which one of the main purposes of the structure is to gain Australian tax benefits or both an Australian and foreign tax benefit.

Australia has had a diverted profits tax (DPT) in force since 2017. Like the MAAL, the Australian DPT also applies to SGEs. The DPT applies a penalty rate of 40 percent on profits that are deemed to have been diverted from the Australian corporate tax base through arrangements that do not reflect economic substance. A cross-border transaction where the tax paid is less than 24 percent is possibly at risk of the DPT. The Australian DPT is designed to be a harsh penalty for business practices that result in corporate taxes being paid at a rate lower than what the tax authority would deem appropriate or avoiding taxes altogether.

Germany: Royalty Barrier Rule

In 2017, Germany introduced a royalty barrier rule that impacts royalties paid on intra-group transactions that are subject to an effective tax rate below 25 percent. The rule denies the deductibility of those payments. However, the royalty barrier does not apply when the recipient of a royalty is covered by Germany’s CFC rules.

The royalty barrier rule was designed to apply to royalty payments for the use of intellectual property (IP) that is in a jurisdiction that provides a tax preference that is deemed to be harmful. A “harmful” tax preference is one that does not follow the BEPS standards for modified nexus.[11] The German Ministry of Finance publishes a list of such policies roughly in line with the OECD’s own list of harmful preferential regimes.

In some cases, a regime is still being reviewed for “harmful” status. This is the case of the U.S. policy on Foreign Derived Intangible Income, which provides a lower tax rate for profits from exports that are connected to intellectual property held within the United States.

United Kingdom: Diverted Profits Tax and IP Tax

As mentioned,, the UK introduced a Diverted Profits Tax (DPT) in 2015. The policy is commonly referred to as the “Google Tax,” and is intended to target tax avoidance practices of large multinationals. This policy sits on top of all the other anti-base erosion rules in the UK and is meant to target specific transactions that tax authorities deemed to be abusive. The application of the tax in the United Kingdom, specifically, is complex and somewhat subjective in nature.[12] The DPT applies a 25 percent tax rate on taxable profits that are artificially diverted away from the UK tax base.

More recently, the UK introduced in 2018 a separate tax targeted at IP located in low-tax jurisdictions. This policy applies to any foreign company with more than ₤10 million in sales derived from IP in countries with corporate tax rates below 50 percent of the UK rate. Businesses subject to the policy need to pay UK corporate tax on their IP income. Offshore income could be exempt from the tax if there is sufficient business substance in the offshore location or if the UK has a double tax treaty with the jurisdiction that includes a nondiscrimination provision.[13]

United States: GILTI, FDII, and BEAT

With the adoption of the TCJA in 2017, the U.S. moved to a partially territorial tax system by providing both a participation exemption for dividends from foreign sources and anti-avoidance rules. In doing so, the U.S. took a unique approach with three new rules: a tax on Global Intangible Low-Tax Income (GILTI), Foreign Derived Intangible Income (FDII), and the Base Erosion and Anti-abuse Tax (BEAT)The Base Erosion and Anti-Abuse Tax (BEAT) was adopted as part of the 2017 tax reform bill and is a tax meant to prevent foreign and domestic corporations operating in the United States from avoiding domestic tax liability by shifting profits out of the United States.

.[14]

GILTI is a new category of foreign income that includes half of foreign earnings exceeding a 10 percent return on a company’s foreign tangible assets. It is subject to a tax rate between 10.5 and 13.125 percent on an annual basis. Foreign tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly.

s applicable to GILTI are limited to 80 percent and excess credits cannot be carried forward. The tax operates on the same platform as Subpart F income, but it is levied at the shareholder level.

A high-tax exemptionA tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the IRS, preventing them from having to pay income tax.

rule that was put in place for Subpart F also applies to GILTI. Foreign profits that are taxed at a rate that is at least 90 percent of the U.S. rate (or 18.9 percent), can be excluded.

While GILTI taxes half of active and passive foreign earnings above a 10 percent return to tangible assets, Subpart F is targeted at passive earnings. Subpart F income is taxed at the full corporate rate of 21 percent, however.

In practice, GILTI may be subject to U.S. taxation even when foreign profits are subject to a foreign tax rate over 13.125 percent. This is because prior law limits on foreign tax credits apply to GILTI’s foreign tax credit.[15]

GILTI was paired with FDII which provides a reduced tax rate for earnings from exports based on intangible assets held within the U.S. FDII was meant to face a similar tax rate as GILTI (13.125 percent) to balance incentives between locating intangible assets offshore or holding them in the U.S.[16]

The BEAT is a tax created to combat earning stripping out of the United States. The tax is applied at a rate of 10 percent of modified taxable income minus the regular corporate tax liability (not below zero).[17] It targets multinational corporations with gross receipts of at least $500 million in the previous three taxable years, with base erosion payments to related foreign corporations that exceed 3 percent (2 percent for certain financial firms) of the total deductions taken during the fiscal year.

The European Union: Anti-Tax Avoidance Directive (ATAD)

In January of 2016, the European Union (specifically, the EU Council) presented a proposal to incorporate some base erosion measures into the EU member states’ tax systems to level the playing field among them.[18] The package lays down rules against tax avoidance that directly affect the functioning of the EU market.

The measures to reduce the risk of base erosion and profit shifting contained in the ATAD include:

- Exit taxation rules

- CFC rules

- Hybrid mismatch rules

- General anti-avoidance rules

- Interest deductibility rules

As of today, most EU countries have finished implementing these rules.

Exit Taxation

Exit taxes are aimed at preventing tax avoidance by the transfer of assets, or other strategies, to move a business from one country to another in search of more favorable tax treatment. For instance, a business may want to move an intellectual property asset from the parent company in the EU to a jurisdiction outside the EU. The business may be seeking better tax treatment for the profits from that asset. The exit tax rules would require the company to pay capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. Capital gains taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment.

to its home jurisdiction in the EU prior to transferring that asset to the foreign jurisdiction. This is a “deemed” capital gain rather than a realized gain since the asset is staying within the same company and is just being relocated to a subsidiary in a different jurisdiction.

CFC Rules

The ATAD provided two models of CFC rules that EU countries could use as a basis for reforming or adopting their own CFC rules. Model A focuses on applying CFC rules to passive income while Model B focuses on taxing income arising from non-genuine arrangements that were specifically designed to gain a tax advantage. Fourteen EU countries have followed Model A in their implementation while nine have followed Model B.[19] Bulgaria, Finland, and France are not following either model while the Netherlands has a combined approach of the two models. See Appendix Table 5 for which countries have adopted the different models.

There are optional exceptions to both Model A and Model B.

For Model A, there are two optional exceptions. First is whether to apply a “substantive economic activities” test for CFCs based in non-European Economic Area countries. The second is whether to use a threshold of one-third of earnings from passive sources as a determining factor in applying CFC tax treatment.

An option under Model B allows countries to exclude some income from a CFC if its accounting profits are less than €750,000 and non-trading (passive) income is less than €75,000 or less than 10 percent of its operating costs.[20]

Hybrid Mismatch Rules

Hybrid mismatches occur when a payment is deductible for an entity in one country and the income from that payment is exempt for an entity in another country. This happens because different countries often have different rules defining deductions or exempt income. Hybrid mismatch rules are aimed to prevent corporations from obtaining benefits from different legal and tax treatment of transactions through the laws of different jurisdictions. The ATAD implementation timeline for hybrid mismatch rules has set January 1, 2022, as the deadline for the rules to be in action. As of August 2020, Romania was the only EU member state that had gained approval from the European Commission for meeting intermediate deadlines on adopting hybrid mismatch rules.[21]

General Anti-avoidance Rules

The General Anti-Avoidance Rule (GAAR) is meant to provide tax authorities with the opportunity to analyze the primary purpose of business arrangements. If, for example, a business arrangement is determined to have the primary purpose of saving money on taxes, the business arrangement can be disregarded for tax purposes. This may mean that an offshore structure is treated as fully taxable in the headquarters’ country.

Interest Deductibility Rules

ATAD provided a template with options for implementing interest deductibility rules. In general, “excess borrowing costs” are deductible up to 30 percent of EBITDA.

However, countries can opt to use a group escape clause based on an equity to total assets ratio. Countries could also choose a “group EBITDA” test where deductions for excess borrowing costs for a corporate group (defined for financial accounting purposes) are limited to 30 percent of EBITDA. Eleven EU member countries use the group escape clause while 15 use the group approach for limiting interest deductions (it is not yet clear which approach Ireland will take).

Countries can also choose to provide a de minimis threshold where borrowing costs are deductible up to €3 million. Twenty-three EU member states have adopted this de minimis threshold.[22] See Appendix Table 4 for which countries have adopted the de minimis threshold or a group escape clause.

The Pillar Two Rules

The model rules for the global minimum tax were released in December 2021.[23] Further commentary and examples of how the rules might apply were released in March 2022 and additional regulatory guidance packages have been released in 2023.

The global minimum tax establishes a 15 percent effective tax rate based on the financial accounts of large corporate entities on a jurisdiction-by-jurisdiction basis. Under the minimum tax, a company would need to calculate the effective tax rate their operations face in each jurisdiction where they have profits. After normal corporate income taxes and taxes paid under controlled foreign corporation rules are accounted for, a top-up may be assessed to ensure the effective tax rate in a jurisdiction is at 15 percent. A substance-based income exclusion is provided both for a share of tangible assets and payroll.

The rules also use a global revenue threshold of €750 million ($790 million) in at least two of the previous four fiscal years with an optional exclusion for entities in a jurisdiction with average revenues below €10 million ($10.55 million) or income less than €1 million ($1.05 million) (the average is calculated using the current year and two previous years). The thresholds determine whether a company needs to comply with the rules in general or in a specific jurisdiction.[24]

The rules lay out four tools for implementing top-up taxes on low-taxed income. Generally, the first three rules apply to the same definition of taxable income, but they differ in which jurisdiction might apply the rule and where a multinational might send its tax payment for the top-up.

The three main rules of the global minimum tax are as follows:

- Qualified Domestic Minimum Top-up Tax (QDMTT): Applies to low-tax profits within a jurisdiction’s own borders.

- Income Inclusion Rule (IIR): Applies to low-tax profits of foreign subsidiaries of a jurisdiction’s own companies.

- Under-taxed Profits Rule (UTPR): Applies to low-tax profits of a subsidiary of a foreign company that has low-tax profits that are not taxed under the other top-up rules.

A fourth rule based in tax treaties is the Subject to Tax Rule (STTR), which a country could use to apply a 9 percent tax on payments to related parties taxed below that rate.

This trio of taxes works redundantly and sequentially to enforce the 15 percent minimum. If they have the intended effect, the IIR and UTPR should create an incentive for countries to create QDMTTs of their own, or otherwise bring their domestic tax rates to 15 percent under the Model Rules. As any MNE headquartered in an IIR country will pay top-up tax, and any MNE with any footprint in a UTPR country will pay top-up tax, the reasoning goes, a jurisdiction might as well collect that top-up tax for itself.

The Limits of Minimum Taxes

Pillar Two may make some base erosion measures less necessary, by compressing the variation in tax rates between jurisdictions. The less variation in headline rates, all else equal, the less incentive there will be for corporations to shift profits between jurisdictions.

However, even a faithfully enforced global minimum tax under the rules of Pillar Two would not end the incentive to shift profits or to become an attractive location for profit shifting. Most trivially, there could still be variation in rates between countries that hew closely to the 15 percent minimum and countries that exceed it.

But more subtly, countries can compete on any number of dimensions—for example, subsidies issued outside the tax system, or with credits classified under Pillar Two’s rules as increases in income rather than reductions in tax—to attract profit-shifting. And they would have an incentive to do so. The global minimum tax’s structure, with its top-ups to 15 percent and its generous credits for taxes paid to other countries, effectively states that Pillar Two does not care which countries a MNE pays 15 percent to, only that it pays 15 percent.

While Pillar Two rules may be indifferent about who collects tax, individual jurisdictions will not be. It matters a great deal to a country whether it, or another country, gets to collect tax. And for highly mobile income, for instance, a jurisdiction may be prepared to offer concessions it values at up to 14 percent of that income, such that it can collect a 15 percent tax and make 1 percent of that income in revenues.[25]

There will always be an incentive to shift profits as long as there is some variation in business policy—tax or otherwise—between jurisdictions, and jurisdictions will always have an incentive to create it. Therefore, base erosion measures will still be relevant, even after an implementation of Pillar Two. However, should Pillar Two succeed even moderately at harmonizing the effective treatment of business income among jurisdictions, base erosion measures that were previously considered necessary may become less so.

Opportunities for Simplification and Reform

As the minimum tax rules come into effect, governments should begin removing or amending other anti-avoidance regimes. In each case explored below, two types of changes are recommended. One type of change is to limit the complexity faced by large multinationals that will be subject both to the targeted anti-avoidance rules and the global minimum tax. The second type of change is for smaller multinationals that are not subject to the global minimum tax.

As described above, many countries have a tax rate test for their CFC rules. This means that if a company has a foreign income in a subsidiary being taxed below a certain rate, additional taxes may be imposed by the country where the headquarters is. Among OECD countries, 29 countries have a tax rate test of this nature in their CFC rules.

For CFC rules, governments should look at two potential reform paths. First, because CFC rules operate similarly to the Income Inclusion Rule in the OECD global minimum tax rules, CFC taxation could be eliminated for large corporations that are subject to the global minimum tax likely without losing much on the efficacy of anti-profit shifting incentives. Second, for companies that are small enough to be outside the scope of the global minimum tax, the CFC legislation could be amended to align (or roughly align) with the 15 percent minimum rate of the global minimum tax.

These CFC reform paths could remove a layer of complexity for businesses subject to both the CFC rules and the global minimum tax while mitigating some of the differences between the treatment of smaller multinationals and larger multinationals.

Denial of deductions takes several forms and the path for reforms are not as obvious as with CFC regimes. In each case, though, policymakers should ask whether the target of a denial of deductions is mitigated by shrinking the gap in effective tax rates on corporate profits. This would suggest that deduction denials for the purpose of limiting tax arbitrage are less useful in the context of the global minimum tax.[26]

Other anti-avoidance regimes like the DPTs and hybrid mismatch rules are also being made redundant in the context of the country-by-country minimum tax. Generally, these policies are cudgels that push companies to pay more under normal corporate income tax rules. However, the motivation for those policies is similar to the motivation for Pillar Two. This creates an opportunity to review those policies and their relative effectiveness compared to the minimum tax even if the policy conclusion may not be as straightforward as with CFC rules.

At the European Union level, where both Pillar Two and many other anti-erosion rules have been put forth in the form of directives from the European Commission, a project that cleans up the ATAD provisions considering Pillar Two would be worthwhile. The Commission could allow EU member states to have flexibility to either exempt (partially or wholly) companies that are subject to Pillar Two from the ATAD.

In the United States

The United States has a variety of pre-Pillar Two base erosion policies, many of which could be reconsidered if Pillar Two is adopted worldwide. It is important, as a general principle, to trim policies that do not work or have become obsolete, especially as new ones are added. This is much preferable to adding continual new layers of poorly-thought-out provisions.[27]

Some of the U.S. base erosion policies have close counterparts in Pillar Two, or even inspired those counterparts. First, and most clearly, the tax on GILTI resembles an IIR enough that it would be unreasonable to maintain a separate GILTI and IIR. One solution is for Congress to modify GILTI to be closer to an IIR. Tax Foundation modeling shows that this is relatively inconsequential from a revenue perspective; while an IIR would have a more stringent country-by-country system, it would also have more generous expense allocation and substance carveouts than GILTI in its current form. The country-by-country system of Pillar Two would, however, be more onerous from a compliance perspective.[28] A second possibility is for the U.S. to negotiate that the tax on GILTI be recognized as a valid IIR for Pillar Two purposes.[29]

In the ideal case, Congress would then consolidate Subpart F into this new international system. As mentioned previously, Subpart F is a CFC rule that has an effective tax rate test similar to other CFC regimes in many countries. That test is 90 percent of the federal corporate tax rate, which with a 21 percent corporate income tax rate, the test in the Subpart F regime is at 18.9 percent.

Second, the Pillar Two requirement for an IIR and a Qualified Domestic Minimum Top-up Tax (QDMTT), both defined by a standard close to book incomeBook income is the amount of income corporations publicly report on their financial statements to shareholders. This measure is useful for assessing the financial health of a business but often does not reflect economic reality and can result in a firm appearing profitable while paying little or no income tax.

, are duplicative with the beleaguered Corporate Alternative Minimum Tax (CAMT) enacted last year. Minimum taxes based on book income are generally unwise.[30] However, it would be worse to have two of them than to have one, and only the QDMTT helps comply with a global tax agreement.

Many other U.S. provisions will remain valid; the U.S. should continue to be a desirable location for highly mobile income through FDII or a similar provision. It should continue to regulate transfer pricing and limit interest deductibility to reasonable levels.

If there is a base erosion measure the U.S. could consider eliminating, BEAT may not be worth its administrative cost. Empirical evidence suggests that firms are averting it through cost reclassification.[31]

Conclusion

International tax policy for MNEs has many problems, some of them intractable. Location of production or income is ill-defined, and perhaps impossible to define completely. Income itself is ill-defined, and perhaps impossible to define completely. International cooperation can be difficult even on simple subjects. Likely, international tax policy will remain a perpetual problem. And unfortunately, perpetual problems spawn a variety of attempts at solutions. Over time these can accumulate, creating cumbersome layers of ineffective or duplicative policies. It is possible that Pillar Two will become one of these layers.

Lawmakers should not give up on curbing profit-shifting, and they should take new efforts like Pillar Two seriously. However, where possible, they should refrain from overloading the tax code with too many complex policies and high compliance costs for what amounts to a relatively small fraction of the world’s income. In a cluttered field like international corporate tax policy, it is just as visionary to reform, consolidate, or remove policies as it is to create them.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

[1]OECD, “Tax Co-operation for the 21st Century: OECD Report for the G7 Finance Ministers and Central Bank Governors,” May 2022, https://www.oecd.org/tax/tax-co-operation-for-the-21st-century-oecd-report-g7-may-2022-germany.pdf#page=18.

[2] The Subpart F regime was adopted in 1962 to tax the passive income of CFCs on an annual basis rather than waiting for earnings to be repatriated.

[3] For an exercise in evaluating the scale of the problem see, Maya Forstater, “Reading the Missing Profits of Nations,” Center for Global Development, Nov. 2018, https://www.cgdev.org/sites/default/files/reading-missing-profits-nations.pdf.

[4] OECD/G20 Base Erosion and Profit Shifting Project, “Designing Effective Controlled Foreign Company Rules, Action 3 – 2015 Final Report,” 2015, https://www.read.oecd-ilibrary.org/taxation/designing-effective-controlled-foreign-company-rules-action-3-2015-final-report_9789264241152-en.

[5] Some countries also have provisions that can redefine income as taxable passive income if abuse is suspected.

[6] Conference of the Representatives of the Governments of the Member States, “Treaty Establishing a Constitution for Europe,” Oct. 29, 2004, http://www.proyectos.cchs.csic.es/euroconstitution/library/constitution_29.10.04/part_III_EN.pdf.

[7] Lilian V. Faulhaber, “Sovereignty, Integration and Tax Avoidance in the European Union: Striking the Proper Balance,” Columbia Journal of Transnational Law 48 (June 2013): 177-241, https://www.ssrn.com/abstract=2272665.

[8] For more information on thin capitalization rules, see OECD, “Thin Capitalisation Legislation,” August 2012, http://www.oecd.org/ctp/tax-global/5.%20thin_capitalization_background.pdf. See also Åsa Johansson, et al., “Anti-Avoidance Rules Against International Tax Planning: A Classification Economics Departments Working Papers No. 1356,” OECD, Feb.16, 2017, https://www.oecd-ilibrary.org/economics/anti-avoidance-rules-against-international-tax-planning_1a16e9a4-en.

[9] OECD, “Action 8-10 Transfer Pricing,” accessed July 2, 2021, https://www.oecd.org/tax/beps/beps-actions/actions8-10/.

[10] Bloomberg Tax, “Overview of Master File/Local File Documentation and CbC Reporting,” 2017, https://www.src.bna.com/zT9.

[11] The most recent list from the OECD is in OECD, “Harmful Tax Practices – Peer Review Results” Inclusive Framework on BEPS, November 2020, https://www.oecd.org/tax/beps/harmful-tax-practices-peer-review-results-on-preferential-regimes.pdf.

[12] Paul Fay, “INSIGHT: The U.K. Diverted Profits Tax—Is It Working?,” Bloomberg Tax, Oct. 18, 2018, https://www.news.bloombergtax.com/daily-tax-report-international/insight-the-uk-diverted-profits-taxis-it-working.

[13] HMRC, “Income Tax: Offshore Receipts in Respect of Intangible Property,” GOV.UK, Oct. 29, 2018, https://www.gov.uk/government/publications/offshore-receipts-from-intangible-property/income-tax-offshore-receipts-in-respect-of-intangible-property.

[14] Kyle Pomerleau, “A Hybrid Approach: The Treatment of Foreign Profits under the Tax Cuts and Jobs Act” Tax Foundation, May 3, 2018, https://www.taxfoundation.org/treatment-foreign-profits-tax-cuts-jobs-act/.

[15] Daniel Bunn, “U.S. Cross-Border Tax Reform and the Cautionary Tale of GILTI,” Feb. 17, 2021, https://taxfoundation.org/research/all/federal/gilti-us-cross-border-tax-reform/

[16] Pomerleau, “A Hybrid Approach: The Treatment of Foreign Profits under the Tax Cuts and Jobs Act.”

[17] Ibid.

[18] The specific ATAD proposals can be found at European Commission, “The Anti Tax Avoidance Directive,” Sept. 13, 2016, https://www.ec.europa.eu/taxation_customs/business/company-tax/anti-tax-avoidance-package/anti-tax-avoidance-directive_en.

[19] While the UK is no longer in the EU, it followed Model A in its approach to implementing ATAD. See Deloitte, “EU Anti-Tax Avoidance Directive: Implementation of Controlled Foreign Company Rules,” March 2021, https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Tax/dttl-tax-eu-anti-tax-avoidance-directive-implementation-of-controlled-foreign-company-rules.pdf.

[20] Ibid.

[21] European Commission, “Report from the Commission to the European Parliament and

the Council on the implementation of Council Directive…,” Aug. 19, 2020, https://www.eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52020DC0383&rid=3.

[22] Deloitte, “EU Anti-Tax Avoidance Directive: Implementation of Interest Expense Limitation Rule,” March 2021, https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Tax/dttl-tax-eu-anti-tax-avoidance-directive-implementation-of-interest-expense-limitation-rule.pdf.

[23] OECD, “Tax Challenges Arising from the Digitalisation of the Economy – Global Anti-Base Erosion Model Rules (Pillar Two),” Dec. 20, 2021, https://www.oecd.org/tax/beps/tax-challenges-arising-from-the-digitalisation-of-the-economy-global-anti-base-erosion-model-rules-pillar-two.htm.

[24] No such exclusion thresholds are available for U.S. companies under GILTI (current law or in the Build Back Better Act).

[25] For analysis of tax competition dynamics within the Pillar Two framework see, Devereux, Michael P., John Vella, and Heydon Wardell-Burrus, “Pillar 2: Rule Order, Incentives, and Tax Competition,” Oxford University Centre for Business Taxation, Jan. 14, 2022, https://oxfordtax.sbs.ox.ac.uk/pillar-2-rule-order-incentives-and-tax-competition.

[26] This does not preclude deduction denials being used to adjust the tax base more toward a cashflow tax. For example, denial of interest deductions is often pointed to as a move toward a cash flow base. To complete such an approach, however, taxation of interest income should be removed.

[27] Daniel Bunn, “Weeding the Garden of International Tax,” Tax Foundation, July 19, 2023, https://taxfoundation.org/blog/decluttering-international-tax-rules/

[28] Alan Cole and Cody Kallen, “Risks to the U.S. Tax Base from Pillar Two,” Tax Foundation, August 30, 2023, https://taxfoundation.org/research/all/federal/global-minimum-tax-us-tax-base/.

[29] Alan Cole, “The U.S. Should Demand More From the OECD Global Minimum Tax Deal,” Bloomberg Tax, July 27, 2023, https://news.bloombergtax.com/tax-insights-and-commentary/the-us-should-demand-more-from-the-oecd-global-minimum-tax-deal

[30] Alex Muresianu and Erica York, It Would Be a Mistake to Resurrect Corporate Alternative Minimum Tax, Tax Foundation, August 4, 2022, https://taxfoundation.org/blog/corporate-alternative-minimum-tax/

[31] Stacy Kelley LaPlante et al., “Just BEAT It: Do firms reclassify costs to avoid the base erosion and anti-abuse tax (BEAT) of the TCJA?,” Singapore Management University School of Accountancy, February 1, 2021, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3784739

Share